Angry phone call from the banker, you're in the red again. Ouch. How to end for good with the galleys of money? In her book Money Therapy (ed. Solar), the Spanish economist Cristina Benito gives the keys to manage your accounts with confidence, even when you are a broken basket. These are the lessons we have learned.

Money is like meditation, you have to be aware of it

Most people tend to shy away from money matters, a subject considered highly taboo in our society. Stop hiding your face! Force yourself to talk about it, if only with yourself. What relationship do you have with money?

Do you have a clear view of your finances? How much do you earn? How much are your expenses? Cristina Benito recommends dealing with these questions mindfully, just like in meditation. Leave the emotional aspect aside to analyze the situation as it is.

Take stock calmly and black on white

Now is the time to take stock of your financial situation. Monthly income and expenses, enter them in a table exhaustively. If the amounts are not fixed, take an average. If they are not monthly, prorate the month.

When it comes to expenses, think about savings! " Experts recommend saving 20% of our net income for medium or long term projects ," said the economist.

Whatever the outcome, keep in mind that it depends on two factors: income, but also expenses.

Stop wasting your time

Your time is precious. To optimize your productivity, adopt the 80/20 law. Developed by Italian economist Vilfredo Pareto , this principle asserts that 80% of effects are the product of 20% of causes. Concretely, identify the 20% of hours of the day when your attention and concentration are at the max, to devote them to the most important tasks, responsible for 80% of your results. You will thus obtain a better return on energy spent / missions accomplished. CQFD.

Wake up dormant money

You don't know it yet, but there's sleeping money right under your nose, you just need to wake it up. Take a good look at the objects around you, do you really need them? Cristina Benito recalls that “owning more than we need ends up costing us money”.

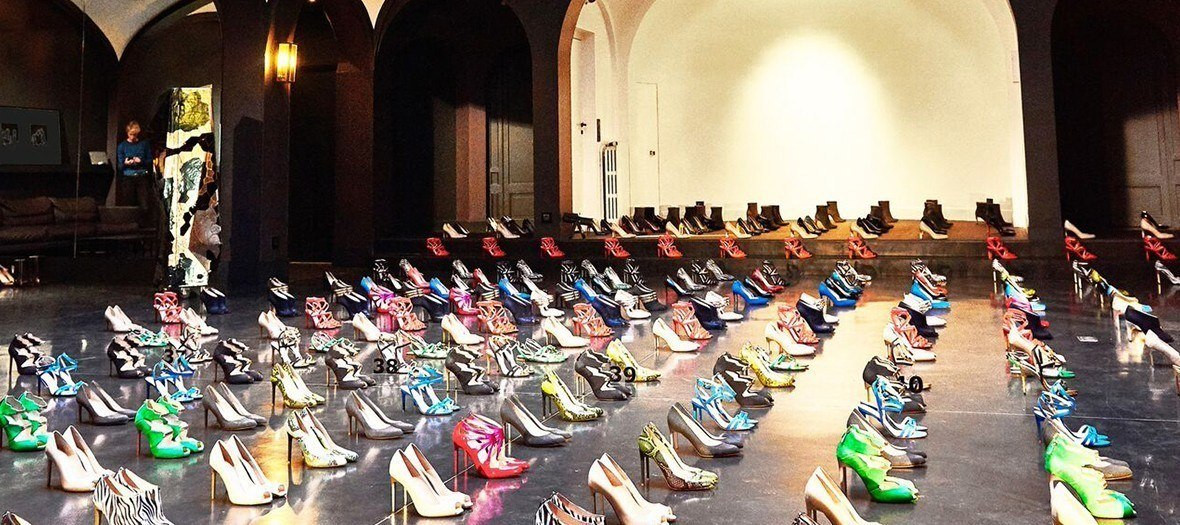

Those clothes you don't wear, those shoes that hurt your feet, those books that collect dust, why keep them? They take up space for nothing, sell them on Vinted . On the one hand, you will generate income from it, on the other hand, it will free up space and lighten your mind. The double effect Kiss Cool.

Reduce your expenses

Rather than strive to always want to earn more, Cristina Benito encourages spending less. According to the expert, “with a relevant strategy, we can reduce our expenses by 20 to 35%”.

How to easily reduce your expenses? Skip the latte at the local coffee-shop, billed at € 3 per day, or € 1,095 per year. Prepare your lunchbox instead of having lunch outside (- € 1,960 / year) or having it delivered (- € 240 / year), cancel unnecessary subscriptions (Netflix, Spotify, gym, etc.) and stop drawing uber all the way.

One last piece of advice, use cash and try to plan your monthly expenses by dividing the corresponding amounts into dedicated envelopes. The aim of the game ? Have the maximum amount of money at the end of the month.

Money Therapy by Cristina Benito, Solar editions, € 16.90.

Also find your horoscope 2020 and the method of storage which is successful .